A Little Goes a Long Way

You can change the life of children around the world for as little as $4.83.

When parents in impoverished areas are given opportunities through Christ-centered microfinance

(microloans or savings programs), the lives of kids are changed.

Why $4.83

In the poorest regions in the world, a donation of $4.83 can help end cyclical poverty through Christ-centered microfinance.

It costs $19.37 to serve one person a microfinance or church-based savings program for one year.¹ An average of 4.01 people live in each household.² When we divide $19.37 by 4.01, we learn it costs $4.83 to help one kid for a year.³

How It Works

Microfinance offers dignity and hope to men and women living in poverty by providing a safe place to save money or offering loans to start or expand businesses.

Microloans

Clients receive a loan to start or expand their small business.

They usually have no access to banking, no collateral, no credit, and would otherwise never qualify for a traditional loan. Loans as small as $100 help pave a path towards dignity, independence, and freedom from extreme poverty. Clients use small amounts of seed capital to invest in their businesses such as selling tomatoes, baking bread, or sewing school uniforms.

Savings Groups

Nonprofits organize groups that meet regularly to save money.

Sometimes, each member may only have enough to save the equivalent of 10 cents per week. But as they pool their money together they’re creating a lump sum they can use for emergencies, school fees, livestock, and much more. The group agrees on interest rates and terms, and the members can invest the funds to start up or expand businesses.

$4.83 Multiplied

Your gift of $4.83 multiplies to help provide individuals with what they need to help their businesses grow.

Your donation goes to financing microloans for families in need.

Families take the loaned funds and

invest in their small business.

Profits go towards savings groups, local businesses and paying off the loan.

This cycle continues to help more families over and over again.

Donate

Small Investment Huge Impact

When you help provide a small loan to an impoverished family, it's not just a transaction.

It's a life-saving gift with eternal implications.

Each family is assigned a local, on-the-ground loan officer who walks beside them each step of the way-giving sound financial advice and biblical counsel, praying for them, and encouraging them to use their loan proceeds in a business that’s sustainable.

Through this relationship, financial situations improve but people also learn to forgive. To love better. To parent better. Biblical principles are integrated into the entire program. Entire families are changing from the inside out through YOUR investment.

Our phase one goal is to raise $483,000 which will help approximately 100,000 kids in need by helping their parents with a microloan or a savings program.

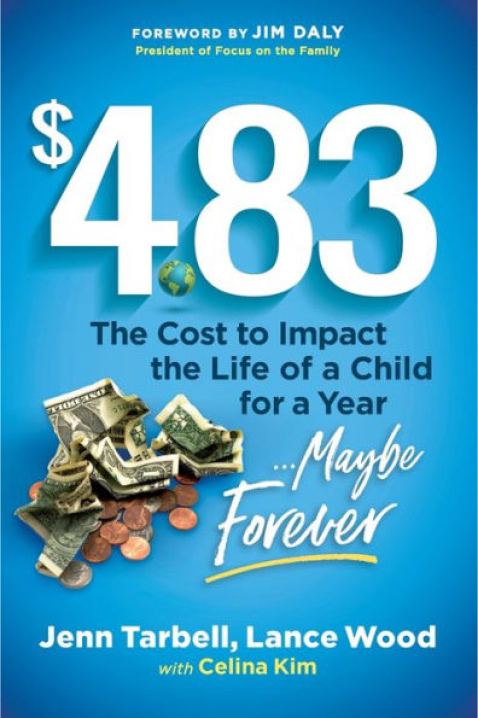

Meet Lance Wood and Jenn Tarbell

When it comes to donating your money, it's important to know who you are trusting with your gift.

Jenn and Lance both are passionate about seeing families thrive. Through their involvement with Christ-centered microfinance organizations, Jenn and Lance saw how these programs not only impacted the parents who are involved, but also their children and communities.

The Evidence is Overwhelming

When parents are given opportunities through Christ-centered microfinance or savings programs, the lives of their kids improve.

This book brings together data and 10 compelling, real-life stories that show how kids win.

PARTNERS

BUY THE BOOK

¹According to our partner HOPE International. ²Based on a United Nations report for the countries where HOPE International operates. ³ We also compared the cost to impact one child’s life for a year across different microfinance organizations and saw similar results.

2025 483 Terms & Conditions Privacy Policy